Introduction: Why Retests Matter in Trading

Trading duniya mein kai strategies hoti hain, lekin “retest” un techniques mein se ek hai jo professional traders baar-baar use karte hain. Retest ek aisi technique hai jahan price ek specific support ya resistance level ko todne ke baad wapas usi level ko test karta hai. Agar aap beginner hain ya intermediate level trader hain, to yeh concept aapke trading results dramatically improve kar sakta hai what is a retest in trading

Retest Kya Hota Hai? Simple Words Mein Samjhein

Retest ka matlab hai price ka ek level (support ya resistance) ko todne ke baad dobara usi level par wapas aana. Is behavior ko traders validate karne ke liye use karte hain ke breakout genuine tha ya fake.

Example:

Agar ek stock ka resistance level $100 hai, aur price $100 ko todta hai aur $105 tak chala jaata hai, to retest tab hoga jab price wapas $100 par aakar support dikhaye.

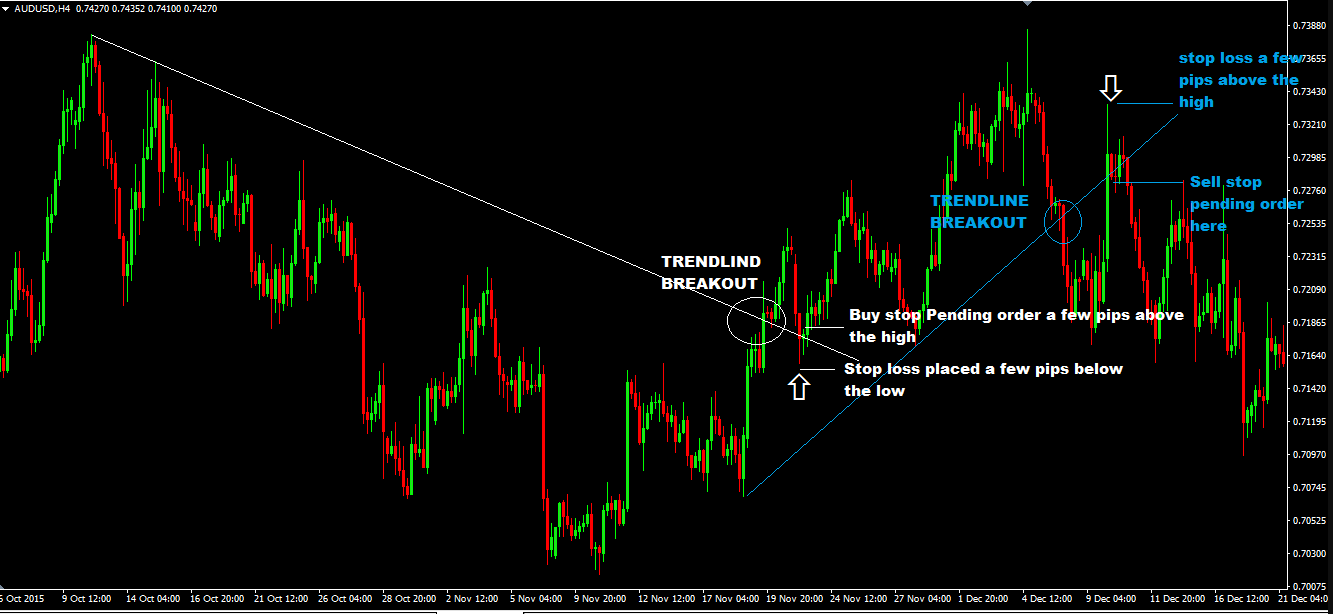

Retest Trading Strategy Kaise Kaam Karti Hai?

Retest trading strategy ka kaam yeh hota hai ke jab price breakout karta hai, traders wait karte hain ke price dobara usi zone par aaye jahan se breakout hua tha. Is retest ke dauraan agar price wahan hold karta hai, to entry lete hain.

Steps:

- Identify key support/resistance.

- Wait for a breakout.

- Let price come back to retest.

- Confirm with candlestick or volume.

- Enter trade.

Retest vs. Pullback: Kya Farq Hai?

Kai log retest aur pullback ko confuse karte hain. Dono similar dikhte hain, lekin subtle differences hote hain.

| Feature | Retest | Pullback |

|---|---|---|

| Occurs After | Breakout | Trend movement |

| Purpose | Test previous level | Short-term correction |

| Signal Strength | Strong reversal point | Often temporary |

Support and Resistance Retest: Key Zones to Watch

Support aur resistance trading ke sabse critical zones hote hain. Jab price in zones ko todta hai, traders alert ho jaate hain.

Support Retest:

Price neeche se support level ko todta hai aur wapas upar aakar test karta hai.

Resistance Retest:

Price resistance todta hai aur neeche aakar dobara us level ko test karta hai.

In dono situations mein, confirmation candles (like hammer, doji, engulfing) entry ke liye signals dete hain.

Types of Retests: Clean vs. Dirty Retest

Clean Retest:

- Price perfectly wapas usi level par aata hai.

- Clear confirmation candles.

- Low risk, high probability.

Dirty Retest:

- Price thoda zone ke upar ya neeche jaata hai.

- Confirmation weak hota hai.

- Thoda risky, but can still work.

Professional traders dono retest ko samajhte hain, lekin clean retest prefer karte hain.

Retest in Uptrend vs. Downtrend

Uptrend:

- Price higher highs banaata hai.

- Resistance break hone ke baad support ban jaata hai.

- Retest pe buy entry li jaati hai.

Downtrend:

- Price lower lows banaata hai.

- Support break hone ke baad resistance ban jaata hai.

- Retest pe sell entry li jaati hai.

Candlestick Patterns for Retest Confirmation

Retest trade mein entry lene se pehle kuch confirmation signals dekhna zaroori hota hai.

Best Candlestick Patterns:

- Bullish Engulfing (for buy)

- Bearish Engulfing (for sell)

- Pin Bar / Hammer

- Doji

- Morning Star / Evening Star

Yeh patterns signal dete hain ke price level ko respect kar raha hai.

Volume Analysis During Retest

Volume trading mein ek powerful indicator hai. Retest ke dauraan agar breakout high volume par hua ho aur retest low volume par ho, to samjhiye breakout genuine hai.

Golden Rule:

- Breakout = High Volume

- Retest = Low Volume

Yeh signal deta hai ke price retest ke baad apni direction continue karega.

Indicators That Help with Retests

Indicators help karte hain retest identify karne aur confirmation dene mein.

Top Indicators:

- Moving Averages (EMA 50, EMA 200)

- RSI (Overbought/Oversold during retest)

- MACD (Crossover during retest)

- Fibonacci Levels (Price retesting key fib levels)

In indicators ke sath chart reading easy ho jaati hai.

Best Timeframes to Use Retest Strategy

Retest har timeframe par kaam karta hai, lekin strategy timeframe ke hisaab se adjust hoti hai.

For Scalping/Intraday:

- 5-min, 15-min charts

For Swing Trading:

- 1-hour, 4-hour charts

For Long-Term:

- Daily or weekly charts

High timeframes par retests zyada reliable hote hain.

Common Mistakes in Retest Trading

- Jaldi Entry lena without confirmation

- Fake breakout ko real samajhna

- Stop loss use na karna

- Indicators ko ignore karna

- Overtrading retest strategy

Yeh galtiyaan avoid karne se accuracy badh jaati hai.

Real-Life Example: Retest on Apple (AAPL) Stock

AAPL stock ne $150 par resistance todha. Price $157 tak gaya, phir wapas aakar $150 par retest kiya. Confirmation candle bani (bullish engulfing) aur price ne phir se rally ki. Yeh ek textbook clean retest tha.

Retest Strategy for Forex Traders

Forex mein retest strategy bahut kaam karti hai, especially during news events. EUR/USD, GBP/USD jese major pairs par yeh strategy high probability setup create karti hai.

Tip:

News ke baad breakout hota hai. Retest ka wait karein, phir entry len.

Retest Trading Strategy

Q1: Retest strategy kis market mein best kaam karti hai?

A: Stocks, forex, crypto — sabhi markets mein retest strategy kaam karti hai.

Q2: Kya retest strategy beginners ke liye suitable hai?

A: Haan, agar confirmation ka wait kiya jaaye to beginners bhi use kar sakte hain.

Q3: Retest aur fakeout mein kya farq hai?

A: Fakeout mein price breakout karta hai lekin sustain nahi karta. Retest mein breakout ke baad price level ko dobara test karta hai.

Q4: Best confirmation signal kya hai?

A: Candlestick patterns + low volume during retest.

Q5: Stop loss kahan lagayein?

A: Support/resistance ke thoda neeche (buy) ya upar (sell) lagana best hota hai.

Conclusion: Retest Strategy Ek Smart Trader Ka Weapon Hai

Retest trading strategy ek proven aur high-probability method hai jise professional traders rozana use karte hain. Yeh strategy aapko impulsive trading se bachati hai aur controlled, confirmed entries provide karti hai. Chahe aap stock trader ho, forex ya crypto — retest strategy har market mein kaam karti hai agar aap patience, confirmation aur discipline ke sath kaam karein.

Aaj hi charts open karke previous retests ko analyse karein — aapko har chart mein ek pattern dikhega. Bas thoda sabr, sahi confirmation, aur ek solid stop loss strategy ke sath aap bhi consistent profits kama sakte hain.